Everything about Frost Pllc

An Unbiased View of Frost Pllc

Table of ContentsNot known Details About Frost Pllc Excitement About Frost PllcSome Known Factual Statements About Frost Pllc Some Known Facts About Frost Pllc.The Main Principles Of Frost Pllc A Biased View of Frost Pllc

The bookkeeping firm completely examines the customer's little organization to recognize its economic standing and demands. Customized solution offering. Based upon this understanding, the firm provides customized services that straighten with the customer's certain objectives and obstacles. Routine communication and updates. Frequent communication is a must. It's up to the company to give normal updates, understandings, and advice.These companies specialize in tax obligation bookkeeping, both on a corporate and specific level. H&R Block is a tax obligation preparation-based firm.

Excitement About Frost Pllc

Similar to the other sorts of audit firms, audit firms can be broken down further in specialty companies. A few of these experts are described as forensic accounting professionals. Tiny niche-based companies such as this are a wonderful means to obtain the most very trained accountants for a particular job. Threat of internal managing companies is made for one certain job.

Firms bring in outsourced audit companies to be that company's audit branch. The role of the firm can vary depending on what the business or service needs at that time.

Small companies often work with bookkeeping companies. If they're incapable to afford expert CPA companies like a bigger business, they decide for making use of bookkeepers to maintain their service' funds. Consider it in this manner. Accounting firms are accounting firms for small companies.

What Does Frost Pllc Mean?

Modern Companies are uncovering that outsourcing bookkeeping and book maintaining is a far better method to achieve effectiveness. Frost PLLC. Among the key reasons that audit outsourcing can be beneficial is the struggle to attain performance in their accountancy with their in-house audit group. Several businesses can not outsource all bookkeeping activities, so they can outsource the restricted activities to a bookkeeping firm if essential

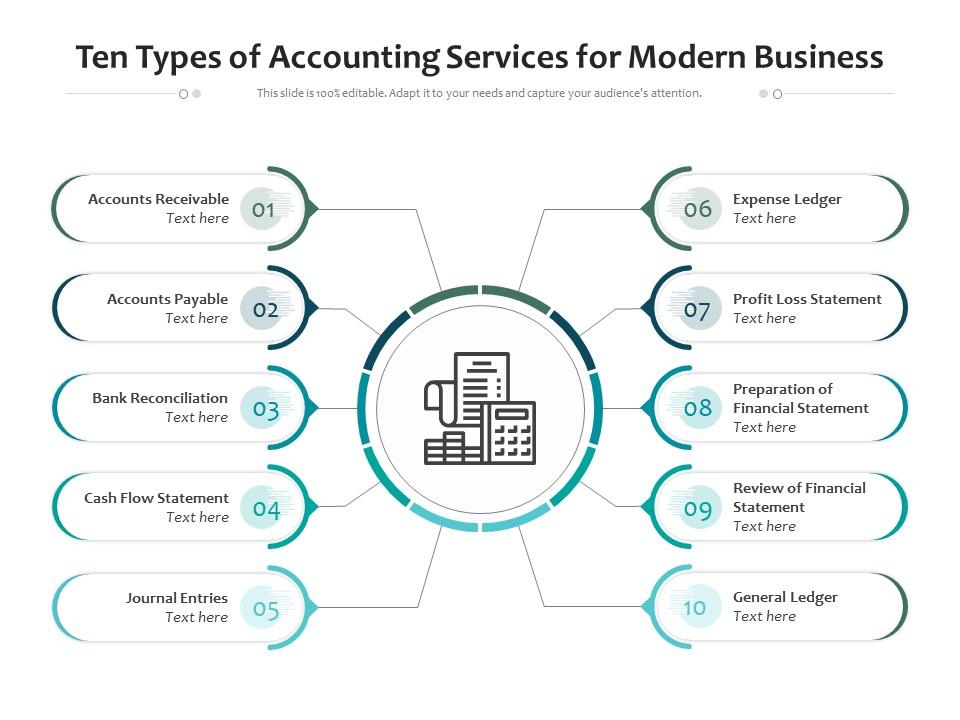

Outsourced audit firms can carry out bookkeeping and finance tasks more successfully in order to supply better solutions. You can discover about the different types of accountancy activities that can be outsourced right here.

Each day, business ought to records all financial deals in the appropriate locations in the business's bookkeeping books. There is a possibility of some errors in these tasks, and if the staff is unskilled, there may be extra mistakes that impact the succeeding accountancy books. Therefore, accounting activities can be contracted out to experts in order to supply even more precise and prompt solution.

Contracting out audit services like this can help you generate higher-quality records that are simple for management to recognize. This will certainly help in making better company choices.

What Does Frost Pllc Mean?

This can eventually assist you enhance your organization's finances. Tax accounting is interested in the payment of called for tax obligation settlements and the appropriate settlement of revenue tax obligation. Outsourcing these accounting solutions can provide far better service because they understand tax obligation regulations, tax settlements, noticing unnecessary taxes, and more. Cost audit is interested in the recording, evaluation, and coverage of the business's major costs.

A proper computation of the pay-roll and other settlements is needed here. Payroll audit can be contracted out to guarantee accuracy and proper pay-roll management. These are some instances of accountancy services that can be outsourced. In addition to these, there are countless other activities that can be handed over. Outsourcing is the process of providing specific activities and duties from your firm to an outdoors service copyright so they may be completed rapidly and you can maintain focusing on your core company.

Frost Pllc Things To Know Before You Buy

Ans: Outsourcing can result in cost savings that are both straight and indirect. You can conserve cash by employing an outsourced model that enhances operating and reporting procedures due to the fact that an outsourced full-time equivalent (FTE) costs up to 50% less than an onsite employee, including their payroll expense, medical care and various other benefits, tools cost, and much more.

This offers management helpful hints and essential stakeholders more time to focus on promoting and increasing business success. When you outsource, you only pay for the services your company actually requires. At Jordensky, we are committed to offering an experience of the greatest caliber while concentrating on audit, tax obligations, MIS, and CFO solutions for start-ups and increasing organizations. When you deal with Jordensky, you get a team of financing professionals that take the money job off your plate "so you can concentrate on your service.

states. They play a critical duty in making sure conformity with bookkeeping standards and regulations, giving services and individuals with confidence in their economic coverage and decision-making processes. For example, a certified public accountant may conduct a thorough audit of an international corporation, identifying areas for functional enhancement and conformity with complicated tax regulations.

Frost Pllc Fundamentals Explained

Financial consultants provide tailored monetary advice and planning solutions to visit homepage people and companies, aiding them achieve their monetary objectives and objectives. They provide proficiency in areas such as financial investments, retirement planning, and tax optimization. In addition, economic consultants carry out regular profile reviews and market analyses to guarantee clients' financial investment techniques remain lined up with their economic goals.

They play a critical role in supplying stakeholders with exact and timely economic details. Financial accountants conduct monetary evaluations to recognize patterns and differences in financial performance and offer suggestions to enhance monetary performance and productivity. In an openly traded firm, an economic accounting professional may prepare quarterly and annual monetary statements.